Why The Netherlands?

If you plan to set up a business in the Netherlands, our team can guide you through the entire process. We have supported entrepreneurs from more than 50 countries with the formation of Dutch BVs, subsidiaries, and branch offices. Thanks to our cooperation with our local notaries, most companies can be incorporated within just a few working days.

Beyond the initial formation, we also assist with practical follow-up services such as applying for a VAT number with the tax office, preparing periodic tax returns, and assisting with the corporate accounting requirements.

Why do companies incorporate in the Netherlands?

Starting a Dutch company is now more profitable than ever. The current corporate income tax in the Netherlands is 19% up to a profit of EUR 200,000 annually, and any profit exceeding EUR 200,000 is taxed at 25.8%.

The Netherlands has a 21% VAT rate on goods and services delivered in the country. Between European Member State countries, goods and services may be offered at a 0% VAT rate. Corporations with a VAT number may additionally claim back paid VAT.

Why Work With Us?

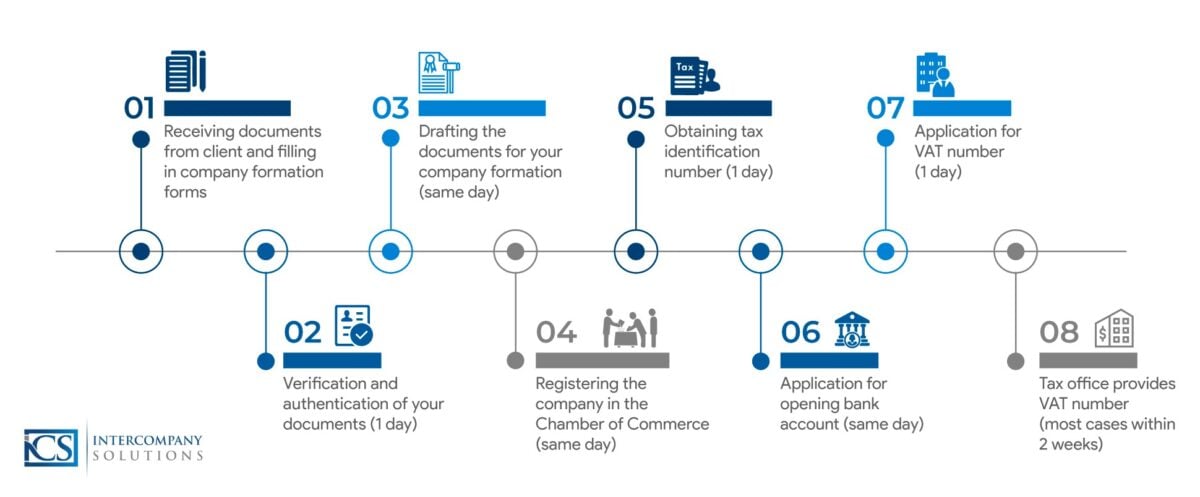

ICS’ partner notaries can incorporate your business in the Netherlands very quickly and also provide a diverse array of all-in services. On average, a Dutch company formation procedure takes around 3-5 business days from the moment we receive your documents. The entire formation process can be realized remotely. There are several documents required for the formation of the company, and all documentation can be handled in English.

Can a foreigner open a company in the Netherlands?

Yes, any foreigner can start a company in the Netherlands! There are some significant advantages to opening a Dutch company, such as:

- 19% corporate tax, one of the lowest tax rates in Europe

- 0% VAT for business between EU member states

- Core member of the EU

- High-tech infrastructure

- The Netherlands ranks 3rd place in Forbes Global Business list

- 5th place in Global Competitiveness

- Leading world banks (ING bank, ABN Amro, Rabobank)

- Excellent international business climate

- 93% English-speaking natives

- Netherlands is a logistical hub as a gateway to Europe

- Qualified personnel (3rd in the world)

- Remote formation of a business is possible

The Netherlands and company formation: What type of company should you choose?

The Dutch BV (private limited company) is the most common company type for a Dutch company setup by foreign investors. The Dutch private limited company can already be registered with a minimum share capital of 1 EUR. A Dutch BV is deemed to be a tax resident in the Netherlands.

The required documentation for the formation of the Dutch BV company includes identification documents as well as power of attorney. A power of attorney is required to be signed by a notary for remote incorporation. However, it is not necessary to travel to the Netherlands to arrange this. All the involved shareholders can authorize our notary to take care of the necessary filings on their behalf.

As such, a personal visit is not required to incorporate a company in the Netherlands, the entire formation procedure can be completed from abroad.

Corporate shareholders (Holding companies)

A private limited company in the Netherlands may have corporate shareholders and directors. For the company incorporation process, the corporate shareholders must be verified and have the authority to sign the deed of incorporation or formation. An extract from the chamber of commerce of the corporate entity must be received, which will act as proof for all shareholders or directors. If the company setup is performed remotely, a power of attorney must be received and signed on behalf of the shareholder or director.

In the case of corporate shareholders, the Dutch company will become a subsidiary. It is also possible to register a Dutch branch office, which has less substance than a subsidiary and may be treated differently by the Dutch tax authorities.

Video explainers on the Dutch BV:

Company Formation Netherlands Timetable

Frequently Asked Questions

What Our Clients Say

Lawyers in Netherlands followed through on their promise. For the application of a VAT number, the tax inspector had some questions about our organization and Lawyers in Netherlands has guided us through that swiftly.

Our firm has assisted the clients of Lawyers in the Netherlands for several years. The Lawyers in Netherlands staff works in a customer orientated and professional manner, the business advisers are dedicated to providing an extra bit of service.

Thank you for assisting me in setting up my business in The Netherlands. I have referred my colleagues to you.